DeFi is an ocean of opportunities, but also a minefield of risks. If you're entering this space with only $1,000 and limited time, the worst thing you can do is gamble it all on speculative tokens. Instead, what you need is a deliberate, strategic approach that maximizes learning, minimizes exposure, and sets you up for long-term success.

This article outlines a practical DeFi plan tailored to those with small capital and tight schedules. You'll discover low-risk strategies, smart airdrop farming, effective liquidity provision, and how to earn passive income with minimal active management — all while building exposure to future opportunities.

Step 1: Start Slow — Your First Rule

If $1,000 is all you can allocate, then it's precious. Don't rush. The first priority is to learn how DeFi works using small amounts — think $10 or $20 — before committing real capital.

Key points:

- Spend time testing wallets, bridges, swaps, and networks.

- Track protocols that offer airdrop points for usage.

- Join community Discords, follow dev teams, and read whitepapers.

"Speed is irrelevant if you're going in the wrong direction."

Step 2: Explore the DeFi Toolbox

Here are the core strategies available in DeFi today:

Lending Platforms (Low Risk)

- Supply stablecoins and earn interest.

- Optional: Borrow against your collateral and re-deposit (looping).

Delta-Neutral Strategies (Medium Risk)

- Long and short the same asset across two platforms.

- Capture funding rate spreads while avoiding market exposure.

Semi-Delta Neutral (Medium-High Risk)

- Slight market exposure with added rewards potential.

Liquidity Pools (Variable Risk)

- Provide tokens to trading pools and earn fees.

- Use full-range LPs (passive) or concentrated LPs (active).

Strategy Spectrum by Risk/Time:

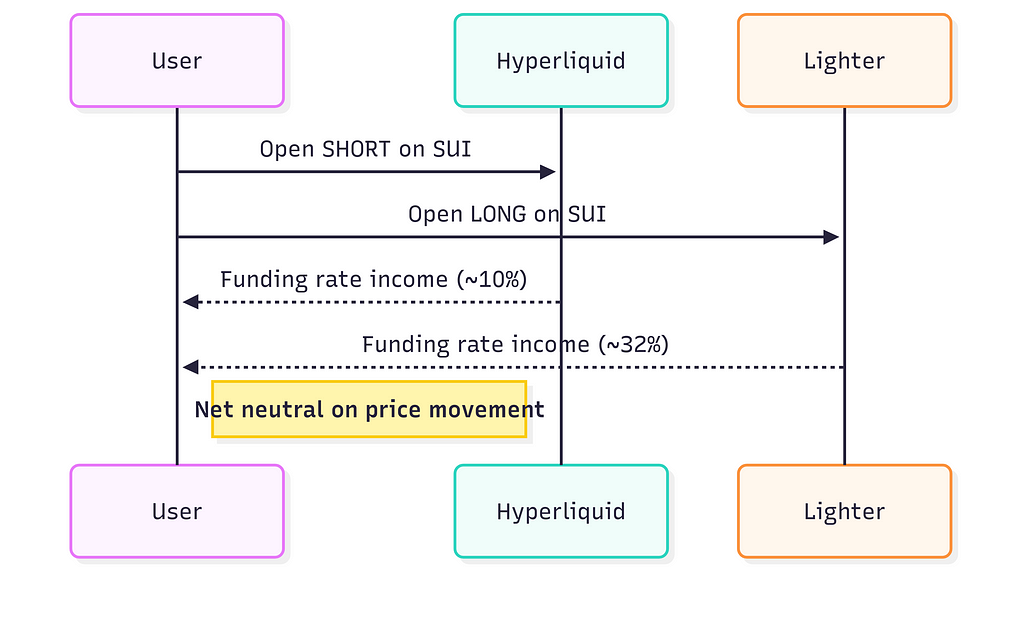

Step 3: Delta-Neutral Yield + Airdrop Farming

Earn APR now + a potential future airdrop — the holy grail of DeFi.

Open mirrored positions across two perpetual DEXes:

- SHORT on one DEX (e.g., Hyperliquid)

- LONG on another DEX (e.g., Lighter)

Example:

- Asset: SUI

- Hyperliquid: SHORT, earning 10.95% APR

- Lighter: LONG, earning -32% APR (you get paid)

Both positions should be set with:

- Matching amounts (e.g., $250 each)

- Matching Stop Loss and Take Profit (inverted)

Bonus:

You earn points on Lighter (confirmed airdrop) and potentially on Hyperliquid (based on past behavior).

Pro tip: Maintain positions open longer to maximize airdrop points. It's not just about volume.

Time commitment: ~10–15 minutes/day

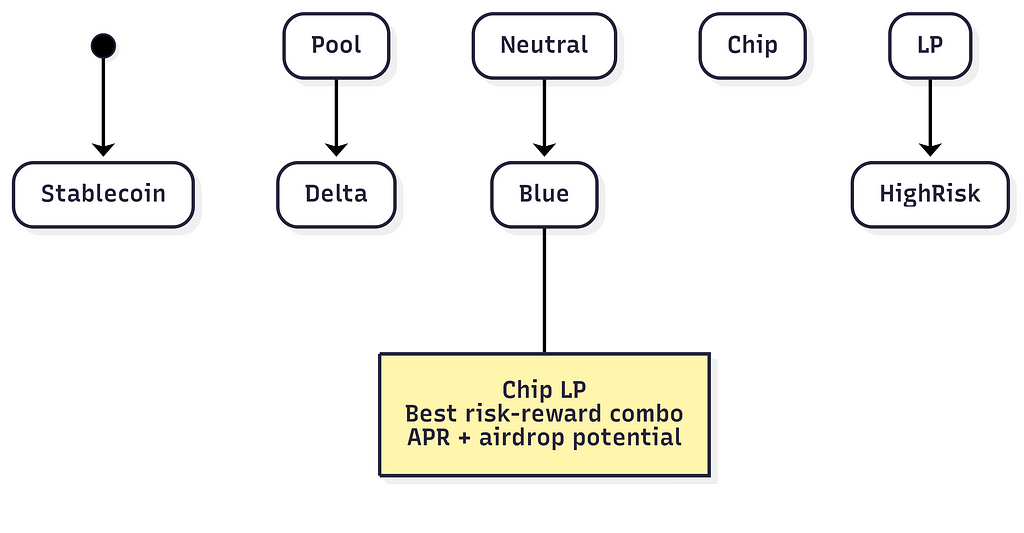

Step 4: Add Liquidity to Blue Chip Pools with Airdrop Potential

Use concentrated liquidity (Uniswap V3-style) on promising DEXs:

- Example: Momentum DEX on SUI network

- Pool: SUI/USDC

- APR: Up to 100%

- Multiplier: x2 points for upcoming airdrop

Why this works:

- SUI is a top-15 token ("blue chip")

- Less volatility than meme coins

- Good APR + future airdrop potential

State Diagram — Risk & Reward

Step 5: Optional High-Risk High-Reward LP

Allocate the last $250 to a low-cap token LP on a growing L2 (e.g., Base):

- Project: Real utility (not meme)

- APR: Up to 1,000%

- Token: Small cap (~$5M market cap)

This is NOT for everyone.

Expect volatility, impermanent loss, and wild swings. But if chosen wisely, these LPs can deliver outsized short-term returns.

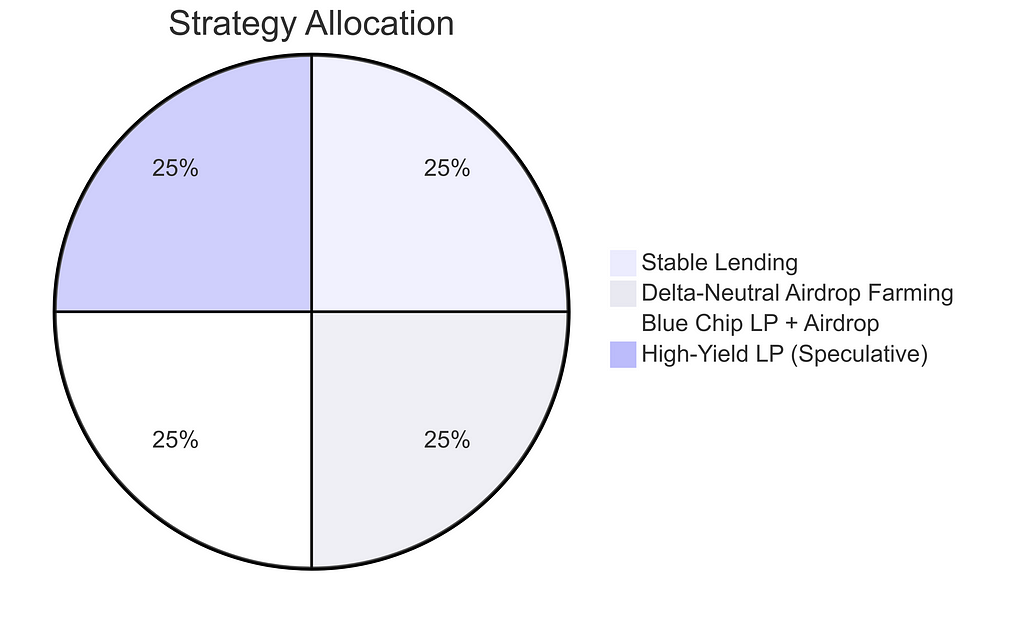

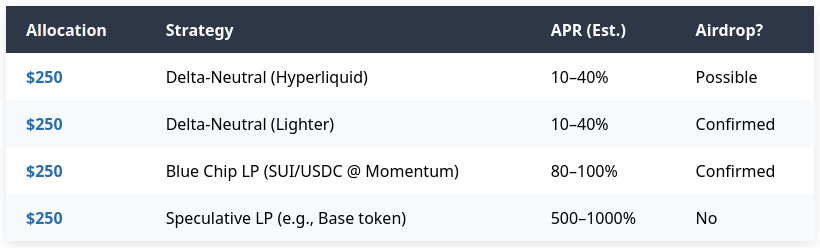

Suggested Portfolio Breakdown

Portfolio Stats:

- 75% of capital in stablecoin pairs

- 25% exposed to token volatility (blue chip + speculative)

- Balanced between current income and future potential

Tips for Success

- Use stop-loss and take-profit to avoid surprises.

- Track APR and adjust positions weekly.

- Don't just chase airdrops — chase value.

- Log everything: deposits, returns, and performance.

Where to Start

Here are some platforms and resources worth checking:

- Hyperliquid — Perpetual DEX, possible airdrop

- Lighter — Perpetual DEX with confirmed airdrop

Keep an eye on whitelisted beta invites, as access may be limited!

Final Thoughts

If you're new to DeFi with limited funds and time, you don't need to gamble to grow. The key lies in combining yield generation with airdrop hunting, all while keeping most of your capital in stable, manageable positions.

In under 3 hours per week, you can:

- Earn double-digit APRs on stablecoins

- Accumulate potential airdrops

- Learn how DeFi really works

Stay disciplined, track everything, and iterate. Remember: DeFi rewards the curious, the early, and the consistent.

What's Your Move?

Would you tweak the allocations? Know another DEX with strong airdrop potential? Drop your thoughts in the comments and let's build smarter together.

source: https://raglup.medium.com/how-to-turn-1-000-and-3-hours-a-week-into-serious-defi-yields-without-gambling-8502e814033f?source=rss-f56f44caad34------2